MASSACHUSETTS

Home Sales Down, Average Price Up

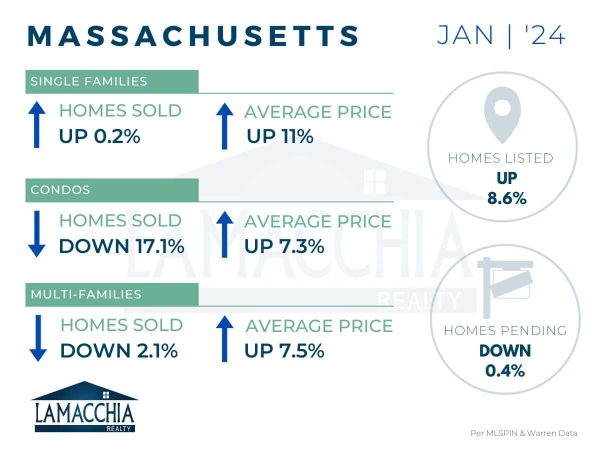

Home sales are down 5.2% year over year, with January 2024 at 3,751 compared to 3,956 last January. Sales are down across all categories, with the exception of single families which are up by 0.2%.

- Single families: 2,392 (2023) | 2,396 (2024)

- Condominiums: 1,176 (2023) | 975 (2024)

- Multi-families: 388 (2023) | 380 (2024)

Average sale price increased 9.7% year-over-year, now at $689,753 compared to $628,936 in January 2023. Prices increased across all categories.

- Single families: $632,613 (2023) | $702,284 (2024)

- Condominiums: $633,473 (2023) | $679,516 (2024)

- Multi-families: $592,514 (2023) | $637,010 (2024)

Homes Listed For Sale:

The number of homes listed is up by 8.6% when compared to January 2023.

- 2024: 4,702

- 2023: 4,330

- 2022: 4,636

Pending Home Sales:

The number of homes placed under contract is down by 0.4% when compared to January 2023.

- 2024: 4,264

- 2023: 4,283

- 2022: 4,865

Price Reductions:

The number of price reductions is down 10% when compared to January 2023.

-

- 2024: 261

- 2023: 290

- 2022: 145

Data provided by Warren Group & MLSPIN then compared to the prior year.

What’s Happening in the Market?

We have seen significant changes to the real estate housing market over the past few years with factors constantly shifting and situations ever evolving. So far, 2024 has proven to be no different. As Anthony states in his 2024 predictions, the market will continue shifting and may even improve slightly for buyers and sellers alike, but we are not out of the woods in terms of housing market ebbs and flows quite yet.

What does this mean for Buyers?

- In Massachusetts inventory is up when compared to 2022, but not nearly enough to meet the buyer demand in the market. This means that being informed and prepared is critical to being successful!

- With buyer affordability diminished due to increased mortgage rates and rising home prices, now more than ever it is important to know what mortgage options are available to you such as buydowns and assumptions. Also, make sure you are ready to strike with updated preapprovals and a plan that works best for you so you can accomplish your buying goals!

What does this mean for Sellers?

- Many sellers are hesitating to list their homes which is contributing to the low inventory levels. Remember, many sellers are also buyers so they do not want to enter the market and give up their low mortgage rate from the pandemic era. Many are also concerned that they will not be able to find a home to move into after theirs sells.

- However, NOW is the best time to list your home! Listing your home now before the influx of sellers in the spring/summer months gives you more leverage to negotiate which is particularly important for those looking to sell and buy at the same time!

- We are also seeing many want-to-be sellers starting to list their homes due to lifestyle changes such as relocating for work or divorce. If you are ready to sell your home, make sure your home is prepped and also priced competitively to generate the most demand!

What’s next?

Mortgage rates and rising home prices continue to play a large role in consumer decision making, along with other economic factors such as inflation. Specifically, in January 2024, mortgage rates loomed close to 7%. Now, recent economic indicators have pushed those rates up past 7%. These rates majorly impact the decisions of both buyers and sellers as stated above. Despite this, given the natural seasonality of the Northeast market, we should see the market start to pick up more as we head towards the spring months.