February 2023

massachusetts housing report

February Highlights

- The Massachusetts housing market is beginning to pick up as we head further into the year, but home sales are still down significantly in February compared to this time last year. Normal seasonality keeps market activity down in the beginning part of the year, but we will undoubtedly see an uptick in activity as we get further into the spring/early summer months. Nationally, existing home sales were up 14.5% in February over last February (up 4.0% in the Northeast).

- Economic factors, chiefly rising inflation, continue to severely impact consumer sentiment and spending, especially as mortgage rates remain increased. In February, mortgage rose to the high 6%s, and even went over 7% in early March. However, while the grander economy continues to struggle, mortgage rates have fallen from these heightened levels and are expected to continue doing so in the weeks to come. Remember, bad for the economy usually translates to good for the housing market and mortgage rates. Anthony explains this in-depth in this recent video!

- Buyers – lowered mortgage rates increase your affordability! There are also several mortgage products available to you such as buydowns and assumptions that can make buying a home more feasible in this market. Make sure you obtain updated preapprovals to account for changing rates so you can be ready to strike and WIN.

- Also, we are starting to see more sellers list their homes (i.e., more supply), so you will have more options to choose from which will inherently lessen the level of competition currently in the market.

- Sellers – get your home on the market! Many sellers are hesitating to list their home because they currently have a low, pandemic era mortgage rate. That explains why listings and pending sales are so far down year over year. However, the sooner you list your home, the more you will sell it for versus waiting a few more months. Right now, inventory is near its lowest, but there are serious buyers in the market looking to purchase. Once inventory starts to rise, that advantage weakens.

- When you do decide to list your home, pricing it correctly will be crucial. Don’t overplay your hand! Homes that are priced competitively for the area are more likely to sell fast and for more money than those priced incorrectly – those will sit on the market!

- Also, in February as Anthony predicted, multiple offers made a comeback as there are far more buyers in the market than sellers currently. As more sellers put their homes on the market, multiple offers will decrease as buyers will have more supply to choose from and less sense of urgency

- Average price increased slightly in MA, and this data indicates two things: 1) that there is still not enough inventory to drive prices dramatically down and 2) there are still a lot of buyers in the market and surely more to enter with these rate drops, so demand in turn increases. However, as the levels continue to creep up we should see price appreciation start to slow and most likely even decrease.

- This market is ever-evolving, so now more than ever working with an experienced and knowledgeable REALTOR® will be imperative to finding your success in the market!

MASSACHUSETTS

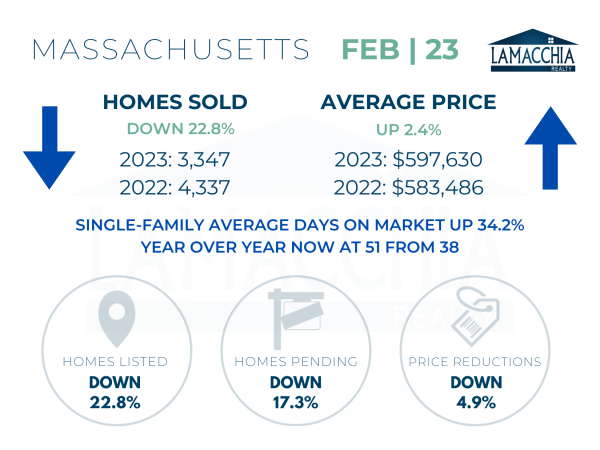

Sales are down 22.8% year over year with February 2023 at 3,347 compared to 4,337 last February. Sales are down across all categories.

- Single families: 2,593 (2022) | 2,040 (2023)

- Condominiums: 1,212 (2022) | 1,018 (2023)

- Multi-families: 532 (2022) | 289 (2023)

Average prices have continued their rise with another year-over-year increase of 2.4%, now at $597,630. Prices increased in every category.

- Single families: $646,844 (2022) | $671,483 (2023)

- Condominiums: $477,622 (2022) | $473,632 (2023)

- Multi-families: $601,951 (2022) | $627,439 (2023)

Homes Listed For Sale:

The number of homes listed is down by 22.8% when compared to February 2022 as would-be sellers are concerned about jumping into the market with all the rising rate headlines.

- 2023: 4,290

- 2022: 5,560

- 2021: 5,876

Pending Home Sales:

The number of homes placed under contract is down by 17.3% when compared to February 2022.

- 2023: 4,519

- 2022: 5,466

- 2021: 6,237

Price Reductions:

The number of price reductions is down 4.9% when compared to February 2022. Sellers, pricing your home right is crucial in this market.

-

- 2023: 195

- 2022: 205

- 2021: 236