February 2023

connecticut housing report

February Highlights

- As we move further into the year, the Connecticut housing market is showing signs of improvement, although home sales in February are still significantly lower compared to last year. This is partially due to normal seasonality patterns in the market, but there is expected to be an increase in activity during the spring and early summer months. Nationally, existing home sales increased by 14.5% in February compared to the same period last year, with a 4.0% increase in the Northeast.

- Rising inflation and other economic factors are having a severe impact on consumer sentiment and spending, especially since mortgage rates rose to over 6%, and even exceeded 7% in early March. However, rates have since fallen and are expected to continue doing so in the coming weeks. Despite the wider economic struggles, this is good news for the housing market and mortgage rates. Anthony explains this in more detail in a recent video.

- For buyers, lower mortgage rates increase affordability, and there are several mortgage products available, such as buydowns and assumptions, that can make buying a home more feasible in this market. It’s important to obtain updated preapprovals to account for changing rates to be able to strike and WIN!

- We are starting to see more sellers list their homes, which increases the supply and provides more options for buyers, resulting in less competition in the market.

- Interestingly in Connecticut, year-over-year inventory levels are at their lowest since 2017 which varies from states like MA and NH. This can be atrributed to the fact that sellers are hesitating to list their homes to keep their low, pandemic era mortgage rates, so there are fewer listings going on the market, and those ones that are listed are staying on longer. Listings that stay on longer will inevitably have to reduce the price to get it sold. As such, average price in Connecticut saw a year over year decrease of 5% in February. Conversely, many sellers know that they cannot overprice their homes now that the market is less frenzied, so many may be pricing more competitively and closer to market value than how they were pricing this time last year.

- Sellers should list their homes as soon as possible to get the most for their home! Right now, inventory is low, and there are serious buyers in the market looking to buy NOW. Once more and more listings come on in the spring, sellers will start to lose their advantage in the market.

- Don’t over play your hand! When listing your home, pricing it correctly is crucial, as competitively priced homes are more likely to sell quickly and for more money.

- As predicted, multiple offers made a comeback in February, as there are currently more buyers than sellers in the market. As more sellers enter the market, multiple offers are expected to decrease.

- As the market continues to evolve, working with an experienced and knowledgeable REALTOR® will be essential to finding success.

CONNECTICUT

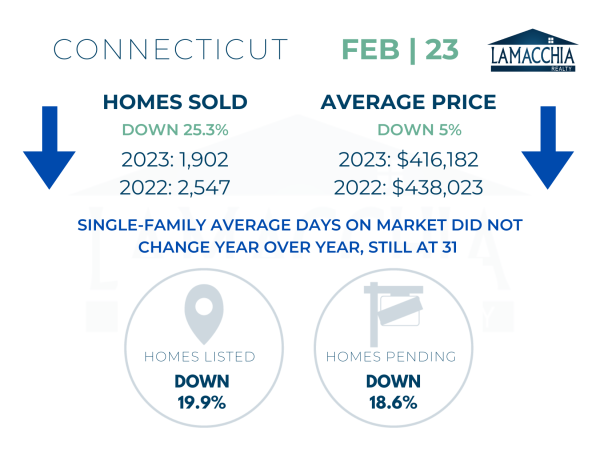

Sales are down 25.3% year over year with February 2023 at 1,902 compared to 2,547 last February. Sales are down across all categories.

- Single families: 1,925 (2022) | 1,451 (2023)

- Condominiums: 622 (2022) | 451 (2023)

Average prices have decreased by 5% compared to last year, now at $416,182 from $438,023. Specifically, single-family prices decreased by 7.7%, but condo prices increased by 9.1%.

- Single families: $496,238 (2022) | $457,929 (2023)

- Condominiums: $258,042 (2022) | $281,571 (2023)

Homes Listed For Sale:

The number of homes listed is down by 19.9% when compared to February 2022 as would-be sellers are concerned about jumping into the market with all the rising rate headlines.

- 2023: 2,615

- 2022: 3,265

- 2021: 3,574

Pending Home Sales:

The number of homes placed under contract is down by 18.6% when compared to February 2022.

- 2023: 2,362

- 2022: 2,902

- 2021: 3,265